Geral

Editorial do WSJ

The Federal Reserve is ending its second round of quantitative easing this month, and Chairman Ben Bernanke was asked recently if he thought the $600 billion in bond purchases had worked. Yes, he replied, because the stock market had risen sharply in value.

Then this week Mr. Bernanke was asked why the economy was lagging. "We don't have a precise read on why this slower pace of growth is persisting," he said, in a rare and revealing case of modesty. Maybe we can shed a little light, and in a way that also explains why so many Americans feel so unhappy about this economic recovery.

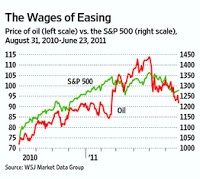

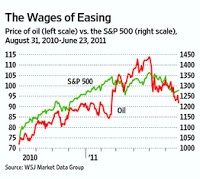

Mr. Bernanke was right about stock prices, which as the nearby chart shows (via the S&P 500) began a steady climb following the chairman's QE2 announcement at Jackson Hole at the end of last August. Mr. Bernanke was attempting to promote what economists call "wealth effects," or an increase in spending that accompanies an increase in perceived wealth. Watching their assets rise in value, the argument goes, Americans will consume and invest more.

At least until the recent market correction, this part of Mr. Bernanke's strategy seemed to be going well. If you owned stocks, you had reason to feel better about the economy and your own financial circumstances.

The problem is that monetary policy is not a laser-guided missile. The Fed can create new dollars, but it can't determine where those dollars will flow in a global economy that still runs mostly on a dollar standard. And with QE2 piling on near-zero rates, dollars flooded into assets other than stocks. In particular, they flowed into emerging markets like China and Brazil and into commodities nearly across the board. The nearby chart also shows the trend in oil prices as one example of the commodity price move.

One result has been a sharp increase in food and energy prices that took gasoline up to $4 a gallon. These have produced what economists call "income effects," or a change in consumption resulting from a change in real income. People who pay $4 for gasoline, or $30 more for groceries, have less money to spend on other goods. They also tend to feel poorer, which can influence their overall confidence in the economy.

One big difference is who feels these effects. The wealth effects have helped everyone but especially the affluent. The income effects have been felt most acutely by the poor and middle classes for whom food and energy are a much higher proportion of income. QE2 and near-zero interest rates have been a boon for bankers and hedge funds. They haven't been so great for suburban families who commute to work and haul their kids to football and music practice. The monetary policy so favored by liberal economists and the White House has actively favored the wealthy over the middle class.

Could these income effects have also hurt economic growth by offsetting the wealth effects that Mr. Bernanke likes to take credit for? Mr. Bernanke concedes that oil prices are one of the "headwinds" that have hurt the recovery, so even he is admitting the possibility. The Fed blames rising oil prices on global demand and Middle East turmoil, which have played a role. But we don't think Mr. Bernanke can take credit for one set of rising asset prices but dodge all responsibility for another.

Meanwhile, the flood of dollars into emerging economies has led to inflation and property bubbles that have caused other central banks to raise interest rates or otherwise try to slow economic growth. Since these economies were leading the world out of recession, their slowdown has hurt growth in the U.S. too.

Of late, both stock and oil prices have fallen, no doubt reflecting this slower economic growth and perhaps the end of QE2. Yesterday, the White House tried to reduce oil prices further by orchestrating a world-wide release of strategic oil stockpiles. (See below.) These lower prices will flow to business and consumers, and perhaps they will help Americans feel less gloomy and cause them to spend more once again.

It was interesting to hear Mr. Bernanke say, during his press conference this week, that "as the price of oil declines"—almost as if he knew the oil stockpile release was coming. Mr. Bernanke has predicted that the oil price rise would be "temporary," so he has a reputational stake in seeing them fall as much as the Obama Administration has a political stake.

The larger economic lesson here concerns the sources of long-term growth and the limits of monetary policy. Easy money can help in a crisis, and it can raise asset prices for a while. But it cannot create a durable recovery, and to the extent it leads to bubbles and higher prices it undermines future growth and erodes middle-class incomes.

The real wellsprings of prosperity are private investment and innovation, which Washington has done so much to retard with regulation, the political allocation of capital, and promises of higher taxes. Reversing those policies would unleash a genuine wealth effect.

- Our Central Bankers Are Intellectually Bankrupt

Ron Paul, Financial Times The financial crisis has fully exposed the intellectual bankruptcy of the world’s central bankers.Why? Central bankers neglect the fact that interest rates are prices. Manipulating those prices through credit expansion or...

- What's Behind Brazil's Slow Growth?

By MARY ANASTASIA O'GRADY, WSJ Along with Russia, India and China, Brazil is supposed to be a 21st century economic tiger. So how come it grew a measly 2.7% last year? President Dilma Rousseff would have you believe that it is because the Federal...

- Why We Can't Believe The Fed

By BENN STEIL, WSJ The bank's predictions of its own behavior are only as good as its predictions of the economy. It has a poor track record. The Federal Reserve's interest rate-setting Open Market Committee recently broke new ground in Chairman...

- The Zero Decade

Editorial do WSJ The two most powerful men in Washington have a big disagreement. No, not President Obama and Speaker John Boehner. We mean Mr. Obama and Federal Reserve Chairman Ben Bernanke, who can't seem to agree on the health of the U.S. economy....

- Twist And Sell

Editorial do WSJ The Federal Reserve-as-economic-savior school took a beating yesterday, after the Fed's Open Market Committee announced its latest policy gambit to avoid a recession. Stocks promptly sold off on the Fed's comments that it now...

Geral

Of Wealth and Incomes

Editorial do WSJ

The Federal Reserve is ending its second round of quantitative easing this month, and Chairman Ben Bernanke was asked recently if he thought the $600 billion in bond purchases had worked. Yes, he replied, because the stock market had risen sharply in value.

Then this week Mr. Bernanke was asked why the economy was lagging. "We don't have a precise read on why this slower pace of growth is persisting," he said, in a rare and revealing case of modesty. Maybe we can shed a little light, and in a way that also explains why so many Americans feel so unhappy about this economic recovery.

Mr. Bernanke was right about stock prices, which as the nearby chart shows (via the S&P 500) began a steady climb following the chairman's QE2 announcement at Jackson Hole at the end of last August. Mr. Bernanke was attempting to promote what economists call "wealth effects," or an increase in spending that accompanies an increase in perceived wealth. Watching their assets rise in value, the argument goes, Americans will consume and invest more.

At least until the recent market correction, this part of Mr. Bernanke's strategy seemed to be going well. If you owned stocks, you had reason to feel better about the economy and your own financial circumstances.

The problem is that monetary policy is not a laser-guided missile. The Fed can create new dollars, but it can't determine where those dollars will flow in a global economy that still runs mostly on a dollar standard. And with QE2 piling on near-zero rates, dollars flooded into assets other than stocks. In particular, they flowed into emerging markets like China and Brazil and into commodities nearly across the board. The nearby chart also shows the trend in oil prices as one example of the commodity price move.

One result has been a sharp increase in food and energy prices that took gasoline up to $4 a gallon. These have produced what economists call "income effects," or a change in consumption resulting from a change in real income. People who pay $4 for gasoline, or $30 more for groceries, have less money to spend on other goods. They also tend to feel poorer, which can influence their overall confidence in the economy.

One big difference is who feels these effects. The wealth effects have helped everyone but especially the affluent. The income effects have been felt most acutely by the poor and middle classes for whom food and energy are a much higher proportion of income. QE2 and near-zero interest rates have been a boon for bankers and hedge funds. They haven't been so great for suburban families who commute to work and haul their kids to football and music practice. The monetary policy so favored by liberal economists and the White House has actively favored the wealthy over the middle class.

Could these income effects have also hurt economic growth by offsetting the wealth effects that Mr. Bernanke likes to take credit for? Mr. Bernanke concedes that oil prices are one of the "headwinds" that have hurt the recovery, so even he is admitting the possibility. The Fed blames rising oil prices on global demand and Middle East turmoil, which have played a role. But we don't think Mr. Bernanke can take credit for one set of rising asset prices but dodge all responsibility for another.

Meanwhile, the flood of dollars into emerging economies has led to inflation and property bubbles that have caused other central banks to raise interest rates or otherwise try to slow economic growth. Since these economies were leading the world out of recession, their slowdown has hurt growth in the U.S. too.

Of late, both stock and oil prices have fallen, no doubt reflecting this slower economic growth and perhaps the end of QE2. Yesterday, the White House tried to reduce oil prices further by orchestrating a world-wide release of strategic oil stockpiles. (See below.) These lower prices will flow to business and consumers, and perhaps they will help Americans feel less gloomy and cause them to spend more once again.

It was interesting to hear Mr. Bernanke say, during his press conference this week, that "as the price of oil declines"—almost as if he knew the oil stockpile release was coming. Mr. Bernanke has predicted that the oil price rise would be "temporary," so he has a reputational stake in seeing them fall as much as the Obama Administration has a political stake.

The larger economic lesson here concerns the sources of long-term growth and the limits of monetary policy. Easy money can help in a crisis, and it can raise asset prices for a while. But it cannot create a durable recovery, and to the extent it leads to bubbles and higher prices it undermines future growth and erodes middle-class incomes.

The real wellsprings of prosperity are private investment and innovation, which Washington has done so much to retard with regulation, the political allocation of capital, and promises of higher taxes. Reversing those policies would unleash a genuine wealth effect.

- Our Central Bankers Are Intellectually Bankrupt

Ron Paul, Financial Times The financial crisis has fully exposed the intellectual bankruptcy of the world’s central bankers.Why? Central bankers neglect the fact that interest rates are prices. Manipulating those prices through credit expansion or...

- What's Behind Brazil's Slow Growth?

By MARY ANASTASIA O'GRADY, WSJ Along with Russia, India and China, Brazil is supposed to be a 21st century economic tiger. So how come it grew a measly 2.7% last year? President Dilma Rousseff would have you believe that it is because the Federal...

- Why We Can't Believe The Fed

By BENN STEIL, WSJ The bank's predictions of its own behavior are only as good as its predictions of the economy. It has a poor track record. The Federal Reserve's interest rate-setting Open Market Committee recently broke new ground in Chairman...

- The Zero Decade

Editorial do WSJ The two most powerful men in Washington have a big disagreement. No, not President Obama and Speaker John Boehner. We mean Mr. Obama and Federal Reserve Chairman Ben Bernanke, who can't seem to agree on the health of the U.S. economy....

- Twist And Sell

Editorial do WSJ The Federal Reserve-as-economic-savior school took a beating yesterday, after the Fed's Open Market Committee announced its latest policy gambit to avoid a recession. Stocks promptly sold off on the Fed's comments that it now...