Geral

- Economics For The Long Run

By JOHN B. TAYLOR, WSJ Individuals should be free to decide what to produce and consume, and their decisions should be made within a predictable policy framework based on the rule of law As this election year begins, a lot of people are wondering what...

- Capitalism And The Right To Rise

In freedom lies the risk of failure. But in statism lies the certainty of stagnation By JEB BUSH, WSJ Congressman Paul Ryan recently coined a smart phrase to describe the core concept of economic freedom: "The right to rise." Think about it. We talk...

- So Much For The Volcker Rule

Editorial do WSJ Even in 298 pages, regulators can't decide what to regulate If you tried to write a parody of the uncertainty and confusion triggered by federal rule-making, it would be hard to top the latest proposal from Washington's financial...

- The Economy Needs A Regulation Time-out

By SUSAN COLLINS, WSJ Last year, the Food and Drug Administration issued a warning to a company that sells packaged walnuts. Believe it or not, the federal government claimed the walnuts were being marketed as a drug. So Washington ordered the company...

- The End Of The Growth Consensus

By JOHN B. TAYLOR, WSJ This month marks the two-year anniversary of the official start of the recovery from the 2007-09 recession. But it's a recovery in name only: Real gross domestic product growth has averaged only 2.8% per year compared with...

Geral

Rules for America's Road to Recovery

By JOHN B. TAYLOR, WSJ

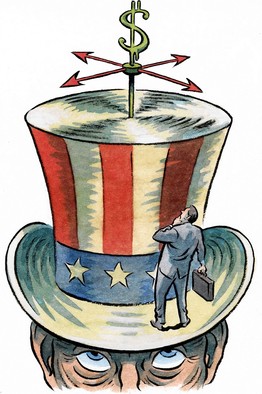

America's economic future is increasingly uncertain. In my view, unpredictable economic policy—massive fiscal "stimulus" and ballooning debt, the Federal Reserve's quantitative easing with multiyear near-zero interest rates, and regulatory uncertainty due to ObamaCare and the Dodd-Frank financial reforms—is the main cause of persistent high unemployment and our feeble recovery from the recession.

A reform strategy built on more predictable, rules-based fiscal, monetary and regulatory policies will help restore economic prosperity. That will be a daunting task, of course, but as they undertake the necessary changes, reformers should pay close attention to what the great economist and philosopher Friedrich A. Hayek wrote in the middle years of the last century.

Hayek argued that the case for rules-based policy goes beyond economics and should appeal to all those concerned about assaults on freedom. He wrote in his classic 1944 book, "The Road to Serfdom," that "nothing distinguishes more clearly conditions in a free country from those in a country under arbitrary government than the observance in the former of the great principles known as the Rule of Law."

Hayek added, "Stripped of all technicalities, this means that government in all its actions is bound by rules fixed and announced beforehand—rules which make it possible to foresee with fair certainty how the authority will use its coercive powers in given circumstances and to plan one's individual affairs on the basis of this knowledge."

Rules-based policies make the economy work better by providing a predictable policy framework within which consumers and businesses make decisions. But they also protect freedom, a concept Hayek developed in his 1960 book, "The Constitution of Liberty."

Hayek traces the relationship of the rule of law to freedom back to Aristotle, and then to Cicero, about whom he wrote, "No other author shows more clearly . . . that freedom is dependent upon certain attributes of the law, its generality and certainty, and the restrictions it places on the discretion of authority." Hayek also quotes from the Second Treatise of Civil Government by John Locke, the father of classical liberalism who had a profound influence on America's Founding Fathers: "The end [meaning the purpose] of law is not to abolish or restrain, but to preserve and enlarge freedom . . . where there is no law, there is no freedom."

Hayek understood that a rules-based system has a dual purpose—freedom and prosperity. Thus the needed reforms in America today—and in any society overburdened by government intervention—are supported by two constituencies: those focused on freedom and those focused on prosperity.

But skeptics ask how a system of policy rules can work when politicians and government officials want to "do something" to help the economy or feel public pressure to do so. A rules-based system with less discretion sounds good in theory, they say, but rules mean you do nothing, and that is impossible in today's charged political climate and 24-hour news cycle.

Hayek had an answer to this. In "The Road to Serfdom" he wrote that it was wrong to say that the "characteristic attitude [of a rules-based system] is inaction of the state" and presented a counter example to this common view, saying that "the state controlling weights and measures (or preventing fraud or deception in any other way) is certainly acting."

Consider other examples. Rules for monetary policy do not mean that the central bank does not change the instruments of policy (interest rates or the money supply) in response to events, or provide loans in the case of a bank run. Rather they mean that they take such actions in a predictable manner.

But in the years immediately preceding the 2008 financial crisis, monetary policy deviated from the more predictable rules-based policy that worked in the 1980s and '90s—i.e., the Federal Reserve held rates too low for too long. Moreover, government regulators did not enforce existing rules on risk-taking at banks and other financial institutions, including Fannie Mae and Freddie Mac.

Then came the discretionary stimulus packages and exploding debt, the regulatory unpredictability associated with ObamaCare and Dodd-Frank, which includes hundreds of rules still waiting to be written, and the unprecedented quantitative easing through which the Federal Reserve bought 77% of new federal debt in 2011.

The U.S. tax code has become particularly unpredictable. The number of provisions expiring has skyrocketed to 133 in 2010-12 from 11 in 2000-02. And now the epitome of unpredictable policy is upon us in the form of a self-inflicted "fiscal cliff" where virtually the entire tax code will be up for grabs by the end of this year.

It is deviation from a rule or a strategy that creates uncertainty and hinders prosperity. Thus, regulators who decide not to act when financial institutions take on risk beyond the limits of the rules and regulations are not being faithful to the law and indeed to the rule of law.

What can citizens do to achieve a more rules-based system? Here Hayek issued a warning. In a chapter in "The Road to Serfdom" called "Why the Worst Get on Top," he argued that there is a bias against individuals in government who firmly believe in rules-based policy. People who have the ambition to get to the top frequently have a bias toward discretionary interventionism, whether motivated by the desire to capture regulatory agencies on behalf of clients, advance the interests of cronies or indeed simply to position themselves for further career advancement later on.

Those who benefit directly from interventions will work hard to make sure that officials who favor discretionary activism advance. Firms in the financial industry, for example, that benefit from a bailout mentality will favor officials who are comfortable with bailouts. Perhaps the answer is to find people who are "overcommitted" to rules-based policy. Then, after all the inevitable pressures and perverse incentives, they may emerge with a sensible balance.

Some will claim, of course, that crises force policy makers to deviate from predictable rules. One can argue that bailouts and other discretionary interventions were needed during the panic of the fall of 2008, and perhaps they prevented a more serious panic. But that is like saying that the person who set fire to your house should be exonerated because he helped put out the fire and saved a few rooms.

Mr. Taylor is professor of economics at Stanford and a senior fellow at the Hoover Institution. His book, "First Principles: Five Keys to Restoring America's Prosperity" (Norton 2012), was awarded the 2012 Hayek prize by the Manhattan Institute. This op-ed is adapted from his Hayek Prize Lecture delivered on May 31.

- Economics For The Long Run

By JOHN B. TAYLOR, WSJ Individuals should be free to decide what to produce and consume, and their decisions should be made within a predictable policy framework based on the rule of law As this election year begins, a lot of people are wondering what...

- Capitalism And The Right To Rise

In freedom lies the risk of failure. But in statism lies the certainty of stagnation By JEB BUSH, WSJ Congressman Paul Ryan recently coined a smart phrase to describe the core concept of economic freedom: "The right to rise." Think about it. We talk...

- So Much For The Volcker Rule

Editorial do WSJ Even in 298 pages, regulators can't decide what to regulate If you tried to write a parody of the uncertainty and confusion triggered by federal rule-making, it would be hard to top the latest proposal from Washington's financial...

- The Economy Needs A Regulation Time-out

By SUSAN COLLINS, WSJ Last year, the Food and Drug Administration issued a warning to a company that sells packaged walnuts. Believe it or not, the federal government claimed the walnuts were being marketed as a drug. So Washington ordered the company...

- The End Of The Growth Consensus

By JOHN B. TAYLOR, WSJ This month marks the two-year anniversary of the official start of the recovery from the 2007-09 recession. But it's a recovery in name only: Real gross domestic product growth has averaged only 2.8% per year compared with...