Geral

Buttonwood, The Economist

Buttonwood, The Economist

THE pattern is eerily familiar. Investors start the year in a blaze of optimism, hoping that the euro zone has been stabilised and that the American economy is growing strongly. By the late spring, the latest example of euro-zone “make and mend” policies shows signs of fraying and the American recovery is proving less robust than hoped. The same description of events applies to both 2011 and 2012, even if last year’s market correction was also triggered by special factors—the terrible damage resulting from the Japanese earthquake and tsunami, along with the Libyan civil war.

This year’s rally really began in late November, and got much of its impetus from the €1 trillion ($1.3 trillion) in three-year loans made by the European Central Bank to the region’s banking system. But the effect of the ECB’s liquidity package has quickly worn off. The MSCI World stockmarket index had gained 12.6% at one stage this year but has seen that advance cut to 2.7%. In Europe, the Euro Stoxx 50 has fallen by 6% in dollar terms; Spanish shares are off by 21%.

Investors have retreated to the safety of selected government bonds. Since the start of 2012, the yields on British and German ten-year government bonds have fallen to levels that are pretty much unprecedented; French yields are a third of a point lower. American yields have fallen, too, but not by as much. The yields on ten-year Bunds are now almost 40 basis points lower than those on Treasuries.

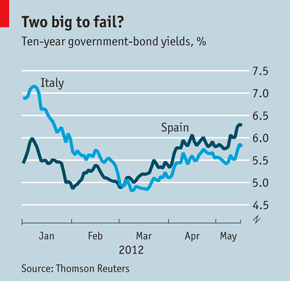

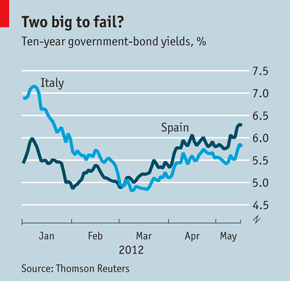

In the periphery the government of Mario Monti in Italy has been more successful in calming the markets than that of Mariano Rajoy in Spain. At the start of the year Italian ten-year yields were almost 150 basis points higher than those of Spain; now they are around 45 basis points lower (see chart). But both are again moving in the wrong direction.

In many ways, the debt crisis confronts euro-zone leaders with a dilemma similar to that facing governments when the banking sector crumbled in 2007 and 2008. Back then, policymakers were forced to distinguish between those banks that were illiquid and just needed emergency loans, and those that were insolvent and needed injections of capital. For a time the authorities appeared to be clueless about this distinction, causing investor alarm. But the American authorities in particular managed to draw a line under their financial crisis by injecting new capital into the (sometimes unwilling) banks and by showing that those banks could pass fairly rigorous stress tests in May 2009. A vigorous equity rally duly occurred.

In contrast, Europe’s leaders have spent much of the past two years treating Greece as a liquidity problem when it is really insolvent. Some of the country’s debts have been forgiven, but not enough. Of course, Europe’s problems are more deep-seated than America’s, thanks to the principal flaw in the euro’s design: that it is a single currency operating in a continent without fiscal union. Politically, it is very hard to reach quick decisions when 17 governments are involved.

But even those countries that are not in the zone have failed to generate the kind of rapid economic growth that has marked previous recoveries. Corporate profits have held up pretty well in the circumstances, which is one reason why the markets are still well ahead of their 2009 levels. But the corollary of those high profits has been depressed real wages, which have weighed on consumer demand. And companies have so far tended to sit on their cash, rather than invest in new plant and equipment or hire new workers.

All this has left the markets desperately waiting for a new “hit” from their central banks, in the form of quantitative easing or additional liquidity support. Each central-bank statement is closely analysed for signs of change, rather as Kremlinologists used to study Politburo photographs for hints of leadership reshuffles.

Like the adrenalin injected into an overdosing Uma Thurman’s heart in “Pulp Fiction”, these central-bank boosts usually provoke an immediate market reaction. But a repeated regime of heroin and adrenalin injections hardly makes for a healthy lifestyle. While it lasts central-bank action means that equity markets are unlikely to crash, since the yields on cash and bonds are so low. At a conference this week organised by Morningstar, a research firm, one fund manager pointed out that Royal Dutch Shell shares yield 4.8%, whereas its bonds pay just 1.5%. But the prospect of markets standing on their own two feet—of surviving without the crutch of massive monetary easing—looks as far away as ever.

- Sweden And The Euro: Out And Happy

The Economist WHEN Swedes voted in 2003 on whether or not to join the euro, most political and business leaders were strongly in favour. Today even the euro’s supporters are grateful to the 56% of voters who said no. As worried investors push up yields...

- The Euro Zone: Is This Really The End?

The Economist Unless Germany and the ECB move quickly, the single currency’s collapse is looming EVEN as the euro zone hurtles towards a crash, most people are assuming that, in the end, European leaders will do whatever it takes to save the single...

- How The Euro Zone Can Restore Confidence

By DAVID MALPASS, WSJ The world is waiting anxiously for Europe to use a bazooka on its debt problems—i.e., to make such a strong financial commitment to European banks and bonds that they become investable again, unfreezing markets. But Europe probably...

- Buttonwood: The Lowdown

The Economist BOND-MARKET vigilantes have a ferocious reputation but it turns out they can be very forgiving. Although Standard & Poor’s has downgraded America’s credit rating and the 2011 budget deficit is expected to be 9% of GDP, the Treasury...

- Ecb Risks Inflation And Loss Of Independence

An Analysis by Stefan Kaiser, Spiegel Online The next taboo has already been broken in Europe, with the European Central Bank now buying up Italian bonds. With its interventionist policies, the ECB is becoming increasingly similar to the US Federal Reserve....

Geral

Here we go again

THE pattern is eerily familiar. Investors start the year in a blaze of optimism, hoping that the euro zone has been stabilised and that the American economy is growing strongly. By the late spring, the latest example of euro-zone “make and mend” policies shows signs of fraying and the American recovery is proving less robust than hoped. The same description of events applies to both 2011 and 2012, even if last year’s market correction was also triggered by special factors—the terrible damage resulting from the Japanese earthquake and tsunami, along with the Libyan civil war.

This year’s rally really began in late November, and got much of its impetus from the €1 trillion ($1.3 trillion) in three-year loans made by the European Central Bank to the region’s banking system. But the effect of the ECB’s liquidity package has quickly worn off. The MSCI World stockmarket index had gained 12.6% at one stage this year but has seen that advance cut to 2.7%. In Europe, the Euro Stoxx 50 has fallen by 6% in dollar terms; Spanish shares are off by 21%.

Investors have retreated to the safety of selected government bonds. Since the start of 2012, the yields on British and German ten-year government bonds have fallen to levels that are pretty much unprecedented; French yields are a third of a point lower. American yields have fallen, too, but not by as much. The yields on ten-year Bunds are now almost 40 basis points lower than those on Treasuries.

In the periphery the government of Mario Monti in Italy has been more successful in calming the markets than that of Mariano Rajoy in Spain. At the start of the year Italian ten-year yields were almost 150 basis points higher than those of Spain; now they are around 45 basis points lower (see chart). But both are again moving in the wrong direction.

In many ways, the debt crisis confronts euro-zone leaders with a dilemma similar to that facing governments when the banking sector crumbled in 2007 and 2008. Back then, policymakers were forced to distinguish between those banks that were illiquid and just needed emergency loans, and those that were insolvent and needed injections of capital. For a time the authorities appeared to be clueless about this distinction, causing investor alarm. But the American authorities in particular managed to draw a line under their financial crisis by injecting new capital into the (sometimes unwilling) banks and by showing that those banks could pass fairly rigorous stress tests in May 2009. A vigorous equity rally duly occurred.

In contrast, Europe’s leaders have spent much of the past two years treating Greece as a liquidity problem when it is really insolvent. Some of the country’s debts have been forgiven, but not enough. Of course, Europe’s problems are more deep-seated than America’s, thanks to the principal flaw in the euro’s design: that it is a single currency operating in a continent without fiscal union. Politically, it is very hard to reach quick decisions when 17 governments are involved.

But even those countries that are not in the zone have failed to generate the kind of rapid economic growth that has marked previous recoveries. Corporate profits have held up pretty well in the circumstances, which is one reason why the markets are still well ahead of their 2009 levels. But the corollary of those high profits has been depressed real wages, which have weighed on consumer demand. And companies have so far tended to sit on their cash, rather than invest in new plant and equipment or hire new workers.

All this has left the markets desperately waiting for a new “hit” from their central banks, in the form of quantitative easing or additional liquidity support. Each central-bank statement is closely analysed for signs of change, rather as Kremlinologists used to study Politburo photographs for hints of leadership reshuffles.

Like the adrenalin injected into an overdosing Uma Thurman’s heart in “Pulp Fiction”, these central-bank boosts usually provoke an immediate market reaction. But a repeated regime of heroin and adrenalin injections hardly makes for a healthy lifestyle. While it lasts central-bank action means that equity markets are unlikely to crash, since the yields on cash and bonds are so low. At a conference this week organised by Morningstar, a research firm, one fund manager pointed out that Royal Dutch Shell shares yield 4.8%, whereas its bonds pay just 1.5%. But the prospect of markets standing on their own two feet—of surviving without the crutch of massive monetary easing—looks as far away as ever.

- Sweden And The Euro: Out And Happy

The Economist WHEN Swedes voted in 2003 on whether or not to join the euro, most political and business leaders were strongly in favour. Today even the euro’s supporters are grateful to the 56% of voters who said no. As worried investors push up yields...

- The Euro Zone: Is This Really The End?

The Economist Unless Germany and the ECB move quickly, the single currency’s collapse is looming EVEN as the euro zone hurtles towards a crash, most people are assuming that, in the end, European leaders will do whatever it takes to save the single...

- How The Euro Zone Can Restore Confidence

By DAVID MALPASS, WSJ The world is waiting anxiously for Europe to use a bazooka on its debt problems—i.e., to make such a strong financial commitment to European banks and bonds that they become investable again, unfreezing markets. But Europe probably...

- Buttonwood: The Lowdown

The Economist BOND-MARKET vigilantes have a ferocious reputation but it turns out they can be very forgiving. Although Standard & Poor’s has downgraded America’s credit rating and the 2011 budget deficit is expected to be 9% of GDP, the Treasury...

- Ecb Risks Inflation And Loss Of Independence

An Analysis by Stefan Kaiser, Spiegel Online The next taboo has already been broken in Europe, with the European Central Bank now buying up Italian bonds. With its interventionist policies, the ECB is becoming increasingly similar to the US Federal Reserve....