Geral

By GENE EPSTEIN, Barron's

Speaking in 1998, just before the launch of the euro in January of the following year, monetary economist Milton Friedman said he was "not optimistic" about the new currency's prospects. "Suppose things go badly, and Italy is in trouble," he observed with eerie prescience.

An independently traded Italian lira, he pointed out, meant the problem could largely be addressed by a plunge in the lira's exchange rate. The downward adjustment in the exchange rate would, in effect, push the troubled economy's prices and wages much lower, in relation to those of neighboring economies, greatly enhancing relative competitiveness. But with a single currency shared by all neighbors, the surgical advantage of this single price-correction mechanism is no longer available. Prices and wages would actually have to fall instead, a much more difficult feat. The likelihood of such "asymmetric shocks hitting the different countries," said Friedman, meant that the euro had an uncertain future.

The economist, who died in 2006, didn't live to see some of his worst fears about the euro become reality, in the form of today's sovereign-debt crises. Plunges in separate currencies would have done much to prevent them, since the troubled debt would have had far more attractive values. But the asymmetric shocks now threatening this noble experiment have, to varying degrees, hit euro members Portugal, Italy, Ireland, Greece and Spain.

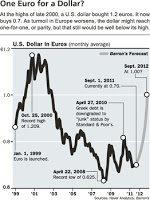

If currency adjustments within the euro zone aren't possible, however, then why not outside it? The dollar looks historically undervalued in relation to the euro (see chart). A good case can be made that the dollar is a buy at its current price of 70 European cents. The greenback might climb to parity with the euro over the next 12 months. Inversely, this means the euro, now worth about $1.43, would fall to $1, still well above its 82.7-cent low of October 2000.

BUT IF THE EURO HAS INDEED BEEN swooning from the asymmetric shocks Friedman warned about, why hasn't it fallen already, at least in relation to the dollar? Greek debt was downgraded to "junk" status by Standard & Poor's in April of last year. Since then, the dollar has actually weakened in relation the euro.

One answer is that the dollar hasn't been looking especially attractive either, since the U.S. economy has been suffering a few well-publicized shocks of its own, including S&P's downgrade of U.S. Treasury debt early last month. So far, then, both currencies have been engaged in a kind of race to the bottom, with the relatively stable exchange rate reflecting a standoff between the two.

The bulls' scenario for the dollar against the euro is based on the conviction that events will significantly alter the market's perception about the relative value of the two currencies, greatly to the euro's detriment. Currency-fund manager John Floyd of New York-based Floyd Capital, who recently went long the dollar, cites a number of storm clouds that could significantly darken the euro zone's prospects. These include difficulties arising from the rescue package assembled in late July, which Floyd avers will result in a "disorderly restructuring of Greek debt by the end of the year."

Adding further to the euro-gloom, in Floyd's view, is that even German Chancellor Angela Merkel's coalition is beginning to question the wisdom of current and future bailouts of weak euro-zone economies. Brown Brothers Harriman currency strategist Marc Chandler, a mild dollar bull, points out that the German high court could issue a ruling on the legality of bailouts as soon as this Wednesday, Sept. 7, with the risk of repercussions for the euro.

Then add the risk that Spain and Italy could come into the picture increasingly as bailout candidates, says Floyd, at a potential cost that would exceed that of Greece by many orders of magnitude.

Dollar bulls tend to emphasize the euro side of the equation. On the dollar side, it is likely that perceptions about the U.S. economy will take a turn for the better.

Recession fears in the U.S. probably abated last week, with the release of August's ISM manufacturing index, which showed continued expansion in domestic manufacturing. Economist Carsten Valgreen, who tracks Europe for Vail, Colo.-based Benderly Economics, believes the euro zone is probably at zero growth in the current quarter. That divergence should help narrow the interest-rate spread between the euro zone and the U.S., to the euro's detriment.

When asked, Valgreen says he, too, would be a dollar bull from these levels. Even though he publishes specific trading recommendations based on his macroeconomic forecasts, he avoids currency trades, in the belief that exchange rates often behave perversely.

He may be right. But broad dollar/euro movements have largely reflected macroeconomic differences. Euro weakness from 1999 through mid-2001 coincided with the tail end of the productivity and stock-market resurgence in the U.S. The gradual recovery of the euro to its 2008 highs reflected the growing credibility of the European Central Bank, while the Federal Reserve presided over a housing bubble.

So perhaps another major move, reflecting a very different sea change in perceptions, is just about to happen. Milton Friedman might approve.

- How The Euro Will End

By GERALD P. O'DRISCOLL JR, WSJ The euro is the world's first currency invented out of whole cloth. It is a currency without a country. The European Union is not a federal state, like the United States, but an agglomeration of sovereign states....

- An Exit Strategy From The Euro

By ROBERT BARRO, WSJ Until recently, the euro seemed destined to encompass all of Europe. No longer. None of the remaining outsider European countries seems likely to embrace the common currency. Seven Eastern European countries that recently joined...

- Sweden And The Euro: Out And Happy

The Economist WHEN Swedes voted in 2003 on whether or not to join the euro, most political and business leaders were strongly in favour. Today even the euro’s supporters are grateful to the 56% of voters who said no. As worried investors push up yields...

- 'euro Bonds Would Destroy The Euro'

Interessante debate no Spiegel Online sobre a crise do euro. Nem preciso dizer qual partido eu tomo. Seguem alguns trechos de Hans-Werner Sinn: "Euro bonds would destroy the euro zone. If all countries -- regardless of their creditworthiness -- were to...

- Buttonwood: Forty Years On

The Economist FORGET Watergate. For economic historians, Richard Nixon’s place in history is secure. He was the president who, 40 years ago, severed the link between global currencies and gold and ended the fixed-exchange-rate system. Under the Bretton...

Geral

Milton Friedman's Euro Smackdown

By GENE EPSTEIN, Barron's

Speaking in 1998, just before the launch of the euro in January of the following year, monetary economist Milton Friedman said he was "not optimistic" about the new currency's prospects. "Suppose things go badly, and Italy is in trouble," he observed with eerie prescience.

An independently traded Italian lira, he pointed out, meant the problem could largely be addressed by a plunge in the lira's exchange rate. The downward adjustment in the exchange rate would, in effect, push the troubled economy's prices and wages much lower, in relation to those of neighboring economies, greatly enhancing relative competitiveness. But with a single currency shared by all neighbors, the surgical advantage of this single price-correction mechanism is no longer available. Prices and wages would actually have to fall instead, a much more difficult feat. The likelihood of such "asymmetric shocks hitting the different countries," said Friedman, meant that the euro had an uncertain future.

The economist, who died in 2006, didn't live to see some of his worst fears about the euro become reality, in the form of today's sovereign-debt crises. Plunges in separate currencies would have done much to prevent them, since the troubled debt would have had far more attractive values. But the asymmetric shocks now threatening this noble experiment have, to varying degrees, hit euro members Portugal, Italy, Ireland, Greece and Spain.

If currency adjustments within the euro zone aren't possible, however, then why not outside it? The dollar looks historically undervalued in relation to the euro (see chart). A good case can be made that the dollar is a buy at its current price of 70 European cents. The greenback might climb to parity with the euro over the next 12 months. Inversely, this means the euro, now worth about $1.43, would fall to $1, still well above its 82.7-cent low of October 2000.

BUT IF THE EURO HAS INDEED BEEN swooning from the asymmetric shocks Friedman warned about, why hasn't it fallen already, at least in relation to the dollar? Greek debt was downgraded to "junk" status by Standard & Poor's in April of last year. Since then, the dollar has actually weakened in relation the euro.

One answer is that the dollar hasn't been looking especially attractive either, since the U.S. economy has been suffering a few well-publicized shocks of its own, including S&P's downgrade of U.S. Treasury debt early last month. So far, then, both currencies have been engaged in a kind of race to the bottom, with the relatively stable exchange rate reflecting a standoff between the two.

The bulls' scenario for the dollar against the euro is based on the conviction that events will significantly alter the market's perception about the relative value of the two currencies, greatly to the euro's detriment. Currency-fund manager John Floyd of New York-based Floyd Capital, who recently went long the dollar, cites a number of storm clouds that could significantly darken the euro zone's prospects. These include difficulties arising from the rescue package assembled in late July, which Floyd avers will result in a "disorderly restructuring of Greek debt by the end of the year."

Adding further to the euro-gloom, in Floyd's view, is that even German Chancellor Angela Merkel's coalition is beginning to question the wisdom of current and future bailouts of weak euro-zone economies. Brown Brothers Harriman currency strategist Marc Chandler, a mild dollar bull, points out that the German high court could issue a ruling on the legality of bailouts as soon as this Wednesday, Sept. 7, with the risk of repercussions for the euro.

Then add the risk that Spain and Italy could come into the picture increasingly as bailout candidates, says Floyd, at a potential cost that would exceed that of Greece by many orders of magnitude.

Dollar bulls tend to emphasize the euro side of the equation. On the dollar side, it is likely that perceptions about the U.S. economy will take a turn for the better.

Recession fears in the U.S. probably abated last week, with the release of August's ISM manufacturing index, which showed continued expansion in domestic manufacturing. Economist Carsten Valgreen, who tracks Europe for Vail, Colo.-based Benderly Economics, believes the euro zone is probably at zero growth in the current quarter. That divergence should help narrow the interest-rate spread between the euro zone and the U.S., to the euro's detriment.

When asked, Valgreen says he, too, would be a dollar bull from these levels. Even though he publishes specific trading recommendations based on his macroeconomic forecasts, he avoids currency trades, in the belief that exchange rates often behave perversely.

He may be right. But broad dollar/euro movements have largely reflected macroeconomic differences. Euro weakness from 1999 through mid-2001 coincided with the tail end of the productivity and stock-market resurgence in the U.S. The gradual recovery of the euro to its 2008 highs reflected the growing credibility of the European Central Bank, while the Federal Reserve presided over a housing bubble.

So perhaps another major move, reflecting a very different sea change in perceptions, is just about to happen. Milton Friedman might approve.

- How The Euro Will End

By GERALD P. O'DRISCOLL JR, WSJ The euro is the world's first currency invented out of whole cloth. It is a currency without a country. The European Union is not a federal state, like the United States, but an agglomeration of sovereign states....

- An Exit Strategy From The Euro

By ROBERT BARRO, WSJ Until recently, the euro seemed destined to encompass all of Europe. No longer. None of the remaining outsider European countries seems likely to embrace the common currency. Seven Eastern European countries that recently joined...

- Sweden And The Euro: Out And Happy

The Economist WHEN Swedes voted in 2003 on whether or not to join the euro, most political and business leaders were strongly in favour. Today even the euro’s supporters are grateful to the 56% of voters who said no. As worried investors push up yields...

- 'euro Bonds Would Destroy The Euro'

Interessante debate no Spiegel Online sobre a crise do euro. Nem preciso dizer qual partido eu tomo. Seguem alguns trechos de Hans-Werner Sinn: "Euro bonds would destroy the euro zone. If all countries -- regardless of their creditworthiness -- were to...

- Buttonwood: Forty Years On

The Economist FORGET Watergate. For economic historians, Richard Nixon’s place in history is secure. He was the president who, 40 years ago, severed the link between global currencies and gold and ended the fixed-exchange-rate system. Under the Bretton...