Geral

Editorial do WSJ

Federal budgets are by definition political documents, but even by that standard yesterday's White House proposal for fiscal year 2013 is a brilliant bit of misdirection. With the abracadabra of a tax increase on the wealthy and defense spending cuts that will never materialize, the White House asserts that in President Obama's second term revenues will soar, outlays will fall, and $1.3 trillion annual deficits will be cut in half like the lady in the box on stage.

All voters need to do is suspend disbelief for another nine months. And ignore the first four years.

The real news in Mr. Obama's budget proposal is the story of those four years, and what a tale they tell.

• Four years of spending of more than 24% of GDP, the four highest spending years since 1946. In the current fiscal year of 2012, despite talk of austerity, Mr. Obama predicts spending will increase by $193 billion to $3.8 trillion, or 24.3% of GDP.

• Another deficit of $1.327 trillion in 2012, also an increase from 2011, and making four years in a row above $1.29 trillion. The last time that happened? Never.

• Revenues at historic lows because of the mediocre recovery and temporary tax cuts that are deadweight revenue losses because they do so little for economic growth. The White House budget office estimates that for the fourth year in a row revenues won't reach 16% of GDP. The last time they were below 16% for any year was 1950.

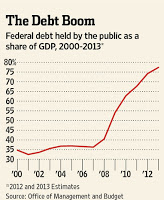

• All of this has added as astonishing $5 trillion in debt in a single Presidential term. National debt held by the public—the kind you have to pay back—will hit 74.2% this year and keep rising to 77.4% next year.

Economists believe that when debt to GDP reaches 90% or so, the economic damage begins to rise. And this doesn't include the debt that future taxpayers owe current and future retirees through the IOUs in the Social Security "trust fund."

But, lo, says the White House, all of this will change in 2013 if Mr. Obama is re-elected. Next year, revenues will suddenly leap to 17.8% of GDP thanks to tax increases on the wealthy, which we are supposed to believe will have little impact on growth.

Meanwhile, spending will fall by one percentage point of GDP to 23.3%, thanks to the automatic cuts in last year's debt-ceiling bill. But more than half of those are scheduled to come out of defense, which even Mr. Obama's Defense Secretary says are unacceptable. They will be renegotiated next year no matter who wins in November.

The cuts also include an estimated $1 trillion in savings in domestic discretionary programs that also won't happen, especially because Mr. Obama's budget proposes to add $350 billion to these programs. His budget also proposes no meaningful reforms in entitlements, which are the fastest growing part of the budget and will grow even faster once ObamaCare really kicks in.

The only thing that you can be certain will become law in this budget if Mr. Obama is re-elected is the monumental tax increase. His plan would raise tax rates across the board on anyone or any business owners making more than $200,000 for individuals and $250,000 for couples. These are the 3% of taxpayers that Mr. Obama says aren't paying their fair share, though that 3% pays more in income tax than the rest of the other 97%.

A central contradiction of this plan is that the White House predicts accelerating real GDP growth of 3% in 2013 and 4.1% by 2015 even as the economy is whacked by these tax increases. The President's plan would also cancel the investment tax rate reductions that have been in place since 2003, impose a new investment income tax hike of 3.8%, and introduce the new "Buffett rule" on the rich.

Tax rates will rise as follows: capital gains to 30% from 15% today; dividends to 30% from 15%; the estate tax to 45% from 35%, and don't forget the end to the temporary payroll tax cut that Mr. Obama is making such an issue of now. He only wants it to last for another 10 months.

And there will be more. Yesterday, Mr. Obama's chief economic adviser, Gene Sperling, reported that the President wants a new "global minimum tax." Mr. Sperling said the new tax is necessary "so that people have the assurance that nobody is escaping doing their fair share as part of a race to the bottom or having our tax code actually subsidize and facilitate people moving their funds to tax havens." He didn't offer specifics but said the White House will be saying more, "perhaps not in gory detail, but in more detail," by the end of the month.

You would think amid all of its other tax increases that the White House wouldn't need another. But its problem is that other countries rudely compete for capital by keeping their tax rates low, so Mr. Obama wants to punish Americans who dare to take that advantage rather than cut the U.S. rate to 25% to make America more competitive.

Despite its tax increases, the White House still predicts that the annual budget deficit will be $901 billion in 2013 and never fall below $575 billion in any of the next 10 years. Democrats denounced George W. Bush for allowing so much red ink, but his deficits averaged only 3.5% of GDP if you don't count 2001 but do include the 10.1% of 2009. Mr. Obama's deficits have averaged 9.1% of GDP if you count 2009, as you should because his $800 billion stimulus passed that February.

The political reality of budgeting is that voters should only believe what they can see, which is what politicians are proposing now. Promises of future spending cuts are a mirage. Mr. Obama needs to point to the mirage because his fiscal record is the worst in modern American history.

- A New Spending Record

Editorial do WSJ Maybe it's a sign of the tumultuous times, but the federal government recently wrapped up its biggest spending year, and its second biggest annual budget deficit, and almost nobody noticed. Is it rude to mention this? The Congressional...

- Obama To Propose Tougher Tax Regime For Wealthy

By DAMIAN PALETTA and CAROL E. LEE, WSJ WASHINGTON -- The White House on Monday plans to launch an effort to prevent millionaires from paying lower tax rates than middle-class Americans as part of its package of ideas to reduce the federal deficit, two...

- The 2013 Tax Cliff

Editorial do WSJ President Obama unveiled part two of his American Jobs Act on Monday, and it turns out to be another permanent increase in taxes to pay for more spending and another temporary tax cut. No surprise there. What might surprise Americans,...

- A Tea Party Triumph

Editorial do WSJ If a good political compromise is one that has something for everyone to hate, then last night's bipartisan debt-ceiling deal is a triumph. The bargain is nonetheless better than what seemed achievable in recent days, especially given...

- The Obama Downgrade

Editorial do WSJ So the credit-rating agencies that helped to create the financial crisis that led to a deep recession are now warning that the U.S. could lose the AAA rating it has had since 1917. As painfully ironic as this is, there's no benefit...

Geral

The Amazing Obama Budget

Editorial do WSJ

Federal budgets are by definition political documents, but even by that standard yesterday's White House proposal for fiscal year 2013 is a brilliant bit of misdirection. With the abracadabra of a tax increase on the wealthy and defense spending cuts that will never materialize, the White House asserts that in President Obama's second term revenues will soar, outlays will fall, and $1.3 trillion annual deficits will be cut in half like the lady in the box on stage.

All voters need to do is suspend disbelief for another nine months. And ignore the first four years.

The real news in Mr. Obama's budget proposal is the story of those four years, and what a tale they tell.

• Four years of spending of more than 24% of GDP, the four highest spending years since 1946. In the current fiscal year of 2012, despite talk of austerity, Mr. Obama predicts spending will increase by $193 billion to $3.8 trillion, or 24.3% of GDP.

• Another deficit of $1.327 trillion in 2012, also an increase from 2011, and making four years in a row above $1.29 trillion. The last time that happened? Never.

• Revenues at historic lows because of the mediocre recovery and temporary tax cuts that are deadweight revenue losses because they do so little for economic growth. The White House budget office estimates that for the fourth year in a row revenues won't reach 16% of GDP. The last time they were below 16% for any year was 1950.

• All of this has added as astonishing $5 trillion in debt in a single Presidential term. National debt held by the public—the kind you have to pay back—will hit 74.2% this year and keep rising to 77.4% next year.

Economists believe that when debt to GDP reaches 90% or so, the economic damage begins to rise. And this doesn't include the debt that future taxpayers owe current and future retirees through the IOUs in the Social Security "trust fund."

But, lo, says the White House, all of this will change in 2013 if Mr. Obama is re-elected. Next year, revenues will suddenly leap to 17.8% of GDP thanks to tax increases on the wealthy, which we are supposed to believe will have little impact on growth.

Meanwhile, spending will fall by one percentage point of GDP to 23.3%, thanks to the automatic cuts in last year's debt-ceiling bill. But more than half of those are scheduled to come out of defense, which even Mr. Obama's Defense Secretary says are unacceptable. They will be renegotiated next year no matter who wins in November.

The cuts also include an estimated $1 trillion in savings in domestic discretionary programs that also won't happen, especially because Mr. Obama's budget proposes to add $350 billion to these programs. His budget also proposes no meaningful reforms in entitlements, which are the fastest growing part of the budget and will grow even faster once ObamaCare really kicks in.

The only thing that you can be certain will become law in this budget if Mr. Obama is re-elected is the monumental tax increase. His plan would raise tax rates across the board on anyone or any business owners making more than $200,000 for individuals and $250,000 for couples. These are the 3% of taxpayers that Mr. Obama says aren't paying their fair share, though that 3% pays more in income tax than the rest of the other 97%.

A central contradiction of this plan is that the White House predicts accelerating real GDP growth of 3% in 2013 and 4.1% by 2015 even as the economy is whacked by these tax increases. The President's plan would also cancel the investment tax rate reductions that have been in place since 2003, impose a new investment income tax hike of 3.8%, and introduce the new "Buffett rule" on the rich.

Tax rates will rise as follows: capital gains to 30% from 15% today; dividends to 30% from 15%; the estate tax to 45% from 35%, and don't forget the end to the temporary payroll tax cut that Mr. Obama is making such an issue of now. He only wants it to last for another 10 months.

And there will be more. Yesterday, Mr. Obama's chief economic adviser, Gene Sperling, reported that the President wants a new "global minimum tax." Mr. Sperling said the new tax is necessary "so that people have the assurance that nobody is escaping doing their fair share as part of a race to the bottom or having our tax code actually subsidize and facilitate people moving their funds to tax havens." He didn't offer specifics but said the White House will be saying more, "perhaps not in gory detail, but in more detail," by the end of the month.

You would think amid all of its other tax increases that the White House wouldn't need another. But its problem is that other countries rudely compete for capital by keeping their tax rates low, so Mr. Obama wants to punish Americans who dare to take that advantage rather than cut the U.S. rate to 25% to make America more competitive.

Despite its tax increases, the White House still predicts that the annual budget deficit will be $901 billion in 2013 and never fall below $575 billion in any of the next 10 years. Democrats denounced George W. Bush for allowing so much red ink, but his deficits averaged only 3.5% of GDP if you don't count 2001 but do include the 10.1% of 2009. Mr. Obama's deficits have averaged 9.1% of GDP if you count 2009, as you should because his $800 billion stimulus passed that February.

The political reality of budgeting is that voters should only believe what they can see, which is what politicians are proposing now. Promises of future spending cuts are a mirage. Mr. Obama needs to point to the mirage because his fiscal record is the worst in modern American history.

- A New Spending Record

Editorial do WSJ Maybe it's a sign of the tumultuous times, but the federal government recently wrapped up its biggest spending year, and its second biggest annual budget deficit, and almost nobody noticed. Is it rude to mention this? The Congressional...

- Obama To Propose Tougher Tax Regime For Wealthy

By DAMIAN PALETTA and CAROL E. LEE, WSJ WASHINGTON -- The White House on Monday plans to launch an effort to prevent millionaires from paying lower tax rates than middle-class Americans as part of its package of ideas to reduce the federal deficit, two...

- The 2013 Tax Cliff

Editorial do WSJ President Obama unveiled part two of his American Jobs Act on Monday, and it turns out to be another permanent increase in taxes to pay for more spending and another temporary tax cut. No surprise there. What might surprise Americans,...

- A Tea Party Triumph

Editorial do WSJ If a good political compromise is one that has something for everyone to hate, then last night's bipartisan debt-ceiling deal is a triumph. The bargain is nonetheless better than what seemed achievable in recent days, especially given...

- The Obama Downgrade

Editorial do WSJ So the credit-rating agencies that helped to create the financial crisis that led to a deep recession are now warning that the U.S. could lose the AAA rating it has had since 1917. As painfully ironic as this is, there's no benefit...