Geral

Editorial do WSJ

So the credit-rating agencies that helped to create the financial crisis that led to a deep recession are now warning that the U.S. could lose the AAA rating it has had since 1917. As painfully ironic as this is, there's no benefit in shooting the messengers. The real culprit is the U.S. political class, especially the President who has presided over this historic collapse of fiscal credibility.

Moody's and the boys are citing the risk of a default on August 2 as the proximate reason for their warning. But Americans should understand that the debt ceiling is merely the trigger. The gun is the spending boom of the last three years and the prospect that Washington lacks the political will to reduce it in the years to come.

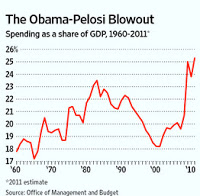

On spending, it is important to recall how extraordinary the blowout of the last three years has been. We've seen nothing like it since World War II. Nothing close. The nearby chart tracks federal outlays as a share of GDP since 1960. The early peaks coincide with the rise of the Great Society, the recession of 1974-75, and then a high of 23.5% with the recession of 1982 and the Reagan defense buildup.

From there, spending declines, most rapidly during the 1990s as defense outlays fell to 3% of GDP in 2000 from its Reagan peak of 6.2% in 1986. The early George W. Bush years saw spending bounce up to a plateau of roughly 20% of GDP, but no more than 20.7% as recently as 2008.

Then came the Obama blowout, in league with Nancy Pelosi's Congress. With the recession as a rationale, Democrats consciously blew up the national balance sheet, lifting federal outlays to 25% in 2009, the highest level since 1945. (Even in 1946, with millions still in the military, spending was only 24.8% of GDP. In 1947 it fell to 14.8%.) Though the recession ended in June 2009, spending in 2010 stayed high at nearly 24%, and this year it is heading back toward 25%.

This is the main reason that federal debt held by the public as a share of GDP has climbed from 40.3% in 2008, to 53.5% in 2009, 62.2% in 2010 and an estimated 72% this year, and is expected to keep rising in the future. These are heights not seen since the Korean War, and many analysts think U.S. debt will soon hit 90% or 100% of GDP.

Congress is responsible for the way so much of this spending was wasted, resulting in little job creation and the slowest economic recovery since the 1930s. But in the U.S. political system, Presidents are supposed to be the fiscal adults. When they abdicate, the teenagers invite over their special interest friends and blow the inheritance.

The President is now claiming to have found fiscal virtue, but notice how hard he has fought House Republicans as they've sought to abate the spending boom. First he used the threat of a government shutdown to whittle the fiscal 2011 spending cuts down to very little. Then he invited Paul Ryan to sit in the front row for a speech while he called his House budget un-American.

Now Mr. Obama is using the debt-ceiling debate as a battering ram not to control spending but to command a tax increase. We're told the White House list of immediate budget savings, the ones that matter most because they are enforceable by the current Congress, are negligible. His offer for immediate domestic nondefense discretionary cuts: $2 billion.

As for Mr. Obama's proposed entitlement cuts, they are all nibbling around the edges of programs that are growing far faster than inflation. He's offering few reforms that would make a difference in the long run. Oh, and ObamaCare is untouchable, despite its $1 trillion in new spending over the next several years, growing even faster after that.

So now we have the inevitable showdown over the debt limit, which must be raised to pay for all of this spending. And Mr. Obama is blaming Republicans for being irresponsible because they won't raise taxes in return for promises of modest future spending restraint. And some people even fall for it.

We've said we think it would be foolish of Republicans to walk into Mr. Obama's debt-limit trap and let him blame them for the financial fallout, including a possible credit downgrade. But this is not because we think they will deserve the blame. Even if this debt-ceiling crisis passes, the threat of a credit downgrade will continue and grow until Mr. Obama changes his policies, or Americans change Presidents.

- The Amazing Obama Budget

Editorial do WSJ Federal budgets are by definition political documents, but even by that standard yesterday's White House proposal for fiscal year 2013 is a brilliant bit of misdirection. With the abracadabra of a tax increase on the wealthy and...

- A New Spending Record

Editorial do WSJ Maybe it's a sign of the tumultuous times, but the federal government recently wrapped up its biggest spending year, and its second biggest annual budget deficit, and almost nobody noticed. Is it rude to mention this? The Congressional...

- What Austerity?

Editorial do WSJ Federal spending will hit a new record this year With the recovery sputtering, the White House and its allies have been blaming government spending cuts, or what the neo-Keynesians call "fiscal contraction." This is a dubious economic...

- Thomas Sowell On Debt Ceiling

Some people may have been shocked when the credit-rating firm Moody's recently suggested that the debt-ceiling law be repealed, in order to avoid fiscal crises which can throw world financial markets into turmoil that can injure countries around the...

- The Road To A Downgrade

Editorial do WSJ Even without a debt default, it looks increasingly possible that the world's credit rating agencies will soon downgrade U.S. debt from the AAA standing it has enjoyed for decades. A downgrade isn't catastrophic because global...

Geral

The Obama Downgrade

Editorial do WSJ

So the credit-rating agencies that helped to create the financial crisis that led to a deep recession are now warning that the U.S. could lose the AAA rating it has had since 1917. As painfully ironic as this is, there's no benefit in shooting the messengers. The real culprit is the U.S. political class, especially the President who has presided over this historic collapse of fiscal credibility.

Moody's and the boys are citing the risk of a default on August 2 as the proximate reason for their warning. But Americans should understand that the debt ceiling is merely the trigger. The gun is the spending boom of the last three years and the prospect that Washington lacks the political will to reduce it in the years to come.

On spending, it is important to recall how extraordinary the blowout of the last three years has been. We've seen nothing like it since World War II. Nothing close. The nearby chart tracks federal outlays as a share of GDP since 1960. The early peaks coincide with the rise of the Great Society, the recession of 1974-75, and then a high of 23.5% with the recession of 1982 and the Reagan defense buildup.

From there, spending declines, most rapidly during the 1990s as defense outlays fell to 3% of GDP in 2000 from its Reagan peak of 6.2% in 1986. The early George W. Bush years saw spending bounce up to a plateau of roughly 20% of GDP, but no more than 20.7% as recently as 2008.

Then came the Obama blowout, in league with Nancy Pelosi's Congress. With the recession as a rationale, Democrats consciously blew up the national balance sheet, lifting federal outlays to 25% in 2009, the highest level since 1945. (Even in 1946, with millions still in the military, spending was only 24.8% of GDP. In 1947 it fell to 14.8%.) Though the recession ended in June 2009, spending in 2010 stayed high at nearly 24%, and this year it is heading back toward 25%.

This is the main reason that federal debt held by the public as a share of GDP has climbed from 40.3% in 2008, to 53.5% in 2009, 62.2% in 2010 and an estimated 72% this year, and is expected to keep rising in the future. These are heights not seen since the Korean War, and many analysts think U.S. debt will soon hit 90% or 100% of GDP.

Congress is responsible for the way so much of this spending was wasted, resulting in little job creation and the slowest economic recovery since the 1930s. But in the U.S. political system, Presidents are supposed to be the fiscal adults. When they abdicate, the teenagers invite over their special interest friends and blow the inheritance.

The President is now claiming to have found fiscal virtue, but notice how hard he has fought House Republicans as they've sought to abate the spending boom. First he used the threat of a government shutdown to whittle the fiscal 2011 spending cuts down to very little. Then he invited Paul Ryan to sit in the front row for a speech while he called his House budget un-American.

Now Mr. Obama is using the debt-ceiling debate as a battering ram not to control spending but to command a tax increase. We're told the White House list of immediate budget savings, the ones that matter most because they are enforceable by the current Congress, are negligible. His offer for immediate domestic nondefense discretionary cuts: $2 billion.

As for Mr. Obama's proposed entitlement cuts, they are all nibbling around the edges of programs that are growing far faster than inflation. He's offering few reforms that would make a difference in the long run. Oh, and ObamaCare is untouchable, despite its $1 trillion in new spending over the next several years, growing even faster after that.

So now we have the inevitable showdown over the debt limit, which must be raised to pay for all of this spending. And Mr. Obama is blaming Republicans for being irresponsible because they won't raise taxes in return for promises of modest future spending restraint. And some people even fall for it.

We've said we think it would be foolish of Republicans to walk into Mr. Obama's debt-limit trap and let him blame them for the financial fallout, including a possible credit downgrade. But this is not because we think they will deserve the blame. Even if this debt-ceiling crisis passes, the threat of a credit downgrade will continue and grow until Mr. Obama changes his policies, or Americans change Presidents.

- The Amazing Obama Budget

Editorial do WSJ Federal budgets are by definition political documents, but even by that standard yesterday's White House proposal for fiscal year 2013 is a brilliant bit of misdirection. With the abracadabra of a tax increase on the wealthy and...

- A New Spending Record

Editorial do WSJ Maybe it's a sign of the tumultuous times, but the federal government recently wrapped up its biggest spending year, and its second biggest annual budget deficit, and almost nobody noticed. Is it rude to mention this? The Congressional...

- What Austerity?

Editorial do WSJ Federal spending will hit a new record this year With the recovery sputtering, the White House and its allies have been blaming government spending cuts, or what the neo-Keynesians call "fiscal contraction." This is a dubious economic...

- Thomas Sowell On Debt Ceiling

Some people may have been shocked when the credit-rating firm Moody's recently suggested that the debt-ceiling law be repealed, in order to avoid fiscal crises which can throw world financial markets into turmoil that can injure countries around the...

- The Road To A Downgrade

Editorial do WSJ Even without a debt default, it looks increasingly possible that the world's credit rating agencies will soon downgrade U.S. debt from the AAA standing it has enjoyed for decades. A downgrade isn't catastrophic because global...