Geral

- O Fim Do Capitalismo Financeiro Desregulado?

«Remember Friday March 14 2008: it was the day the dream of global free-market capitalism died. For three decades we have moved towards market-driven financial systems. By its decision to rescue Bear Stearns, the Federal Reserve, the institution responsible...

- Obama's Real Spending Record

By ARTHUR B. LAFFER AND STEPHEN MOORE, WSJ President Obama shocked us the other day when he said, "Since I've been president, federal spending has risen at the lowest pace in nearly 60 years." Having heard him champion the "multiplier effects" of...

- Why Ron Paul Matters

By EDWARD H. CRANE, wSJ The controversy surrounding decades-old newsletters to which GOP presidential aspirant Ron Paul lent his name is regrettable. First, it is regrettable because the sometimes bigoted, intolerant content of those newsletters is inconsistent...

- O Sábio Profeta

Q: Thank you very much. Before we sign off, could I just take the opportunity to ask you what you think the prospects are for the attempts in Europe to create a common currency area? Are you optimistic about their success? A: I think it's a big...

- Blame The Fed For The Financial Crisis

By RON PAUL, WSJ To know what is wrong with the Federal Reserve, one must first understand the nature of money. Money is like any other good in our economy that emerges from the market to satisfy the needs and wants of consumers. Its particular usefulness...

Geral

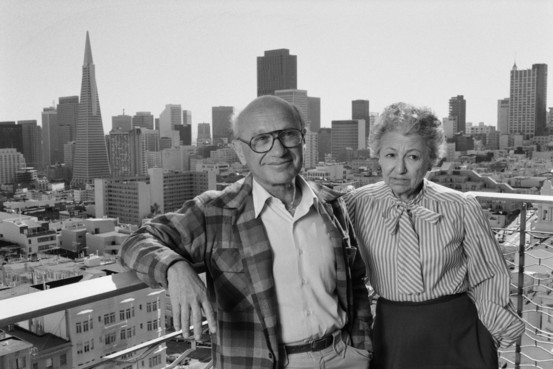

The Man Who Saved Capitalism

By STEPHEN MOORE, WSJ

It's a tragedy that Milton Friedman—born 100 years ago on July 31—did not live long enough to combat the big-government ideas that have formed the core of Obamanomics. It's perhaps more tragic that our current president, who attended the University of Chicago where Friedman taught for decades, never fell under the influence of the world's greatest champion of the free market. Imagine how much better things would have turned out, for Mr. Obama and the country.

Friedman was a constant presence on these pages until his death in 2006 at age 94. If he could, he would surely be skewering today's $5 trillion expansion of spending and debt to create growth—and exposing the confederacy of economic dunces urging more of it.

In the 1960s, Friedman famously explained that "there's no such thing as a free lunch." If the government spends a dollar, that dollar has to come from producers and workers in the private economy. There is no magical "multiplier effect" by taking from productive Peter and giving to unproductive Paul. As obvious as that insight seems, it keeps being put to the test. Obamanomics may be the most expensive failed experiment in free-lunch economics in American history.

Equally illogical is the superstition that government can create prosperity by having Federal Reserve Chairman Ben Bernanke print more dollars. In the very short term, Friedman proved, excess money fools people with an illusion of prosperity. But the market quickly catches on, and there is no boost in output, just higher prices.

Next to Ronald Reagan, in the second half of the 20th century there was no more influential voice for economic freedom world-wide than Milton Friedman. Small in stature but a giant intellect, he was the economist who saved capitalism by dismembering the ideas of central planning when most of academia was mesmerized by the creed of government as savior.

Friedman was awarded the Nobel Prize in economics for 1976—at a time when almost all the previous prizes had gone to socialists. This marked the first sign of the intellectual comeback of free-market economics since the 1930s, when John Maynard Keynes hijacked the profession. Friedman's 1971 book "A Monetary History of the United States," written with Anna Schwartz (who died on June 21), was a masterpiece and changed the way we think about the role of money.

More influential than Friedman's scholarly writings was his singular talent for communicating the virtues of the free market to a mass audience. His two best-selling books, "Capitalism and Freedom" (1962) and "Free to Choose" (1980), are still wildly popular. His videos on YouTube on issues like the morality of capitalism are brilliant and timeless.

In the early 1990s, Friedman visited poverty-stricken Mexico City for a Cato Institute forum. I remember the swirling controversy ginned up by the media and Mexico's intelligentsia: How dare this apostle of free-market economics be given a public forum to speak to Mexican citizens about his "outdated" ideas? Yet when Milton arrived in Mexico he received a hero's welcome as thousands of business owners, students and citizen activists hungry for his message encircled him everywhere he went, much like crowds for a modern rock star.

Once in the early 1960s, Friedman wrote the then-U.S. ambassador to New Delhi, John Kenneth Galbraith, that he would be lecturing in India. By all means come, the witty but often wrong Galbraith replied: "I can think of nowhere your free-market ideas can do less harm than in India." As fate would have it, India did begin to embrace Friedmanism in the 1990s, and the economy began to soar. China finally caught on too.

Friedman stood unfailingly and heroically with the little guy against the state. He used to marvel that the intellectual left, which claims to espouse "power to the people," so often cheers as states suppress individual rights.

While he questioned almost every statist orthodoxy, he fearlessly gored sacred cows of both political parties. He was the first scholar to sound the alarm on the rotten deal of Social Security for young workers—forced to pay into a system that will never give back as much as they could have accumulated on their own. He questioned the need for occupational licenses—which he lambasted as barriers to entry—for everything from driving a cab to passing the bar to be an attorney, or getting an M.D. to practice medicine.

He loved turning the intellectual tables on liberals by making the case that regulation often does more harm than good. His favorite example was the Food and Drug Administration, whose regulations routinely delay the introduction of lifesaving drugs. "When the FDA boasts a new drug will save 10,000 lives a year," he would ask, "how many lives were lost because it didn't let the drug on the market last year?"

He supported drug legalization (much to the dismay of supporters on the right) and was particularly proud to be an influential voice in ending the military draft in the 1970s. When his critics argued that he favored a military of mercenaries, he would retort: "If you insist on calling our volunteer soldiers 'mercenaries,' I will call those who you want drafted into service involuntarily 'slaves.'"

By the way, he rarely got angry and even when he was intellectually slicing and dicing his sparring partners he almost always did it with a smile. It used to be said that over the decades at the University of Chicago and across the globe, the only one who ever defeated him in a debate was his beloved wife and co-author Rose Friedman.

The issue he devoted most of his later years to was school choice for all parents, and his Friedman Foundation for Educational Choice is dedicated to that cause. He used to lament that "we allow the market, consumer choice and competition to work in nearly every industry except for the one that may matter most: education."

As for congressional Republicans who are at risk of getting suckered into a tax-hike budget deal, they may want to remember another Milton Friedman adage: "Higher taxes never reduce the deficit. Governments spend whatever they take in and then whatever they can get away with."

No doubt because of his continued popularity, the left has tried to tie Friedman and his principles of free trade, low tax rates and deregulation to the global financial meltdown in 2008. Economist Joseph Stiglitz charged that Friedman's "Chicago School bears the blame for providing a seeming intellectual foundation" for the "idea that markets are self-adjusting and the best role for government is to do nothing." Occupy Wall Street protesters were often seen wearing T-shirts which read: "Milton Friedman: Proud Father of Global Misery."

The opposite is true: Friedman opposed the government spending spree in the 2000s. He hated the government-sponsored enterprises like housing lenders Fannie Mae and Freddie Mac.

In a recent tribute to Friedman in the Journal of Economic Literature, Harvard's Andrei Shleifer describes 1980-2005 as "The Age of Milton Friedman," an era that "witnessed remarkable progress of mankind. As the world embraced free-market policies, living standards rose sharply while life expectancy, educational attainment, and democracy improved and absolute poverty declined."

Well over 200 million were liberated from poverty thanks to the rediscovery of the free market. And now as the world teeters close to another recession, leaders need to urgently rediscover Friedman's ideas.

I remember asking Milton, a year or so before his death, during one of our semiannual dinners in downtown San Francisco: What can we do to make America more prosperous? "Three things," he replied instantly. "Promote free trade, school choice for all children, and cut government spending."

How much should we cut? "As much as possible."

Mr. Moore is a member of the Journal's editorial board.

- O Fim Do Capitalismo Financeiro Desregulado?

«Remember Friday March 14 2008: it was the day the dream of global free-market capitalism died. For three decades we have moved towards market-driven financial systems. By its decision to rescue Bear Stearns, the Federal Reserve, the institution responsible...

- Obama's Real Spending Record

By ARTHUR B. LAFFER AND STEPHEN MOORE, WSJ President Obama shocked us the other day when he said, "Since I've been president, federal spending has risen at the lowest pace in nearly 60 years." Having heard him champion the "multiplier effects" of...

- Why Ron Paul Matters

By EDWARD H. CRANE, wSJ The controversy surrounding decades-old newsletters to which GOP presidential aspirant Ron Paul lent his name is regrettable. First, it is regrettable because the sometimes bigoted, intolerant content of those newsletters is inconsistent...

- O Sábio Profeta

Q: Thank you very much. Before we sign off, could I just take the opportunity to ask you what you think the prospects are for the attempts in Europe to create a common currency area? Are you optimistic about their success? A: I think it's a big...

- Blame The Fed For The Financial Crisis

By RON PAUL, WSJ To know what is wrong with the Federal Reserve, one must first understand the nature of money. Money is like any other good in our economy that emerges from the market to satisfy the needs and wants of consumers. Its particular usefulness...